The CSRD enters into force in early january 2023 and is relevant to all companies

Business Law

On 28 November 2022, the Council of the European Union adopted the "Corporate Sustainability Reporting Directive" (the "CSRD"). It requires certain companies to conduct sustainability reporting to provide information on how they handle the environment, social and good governance (the so-called "ESG" factors), as well as the impact of their business activities on them.

Although the CSRD is mainly aimed at large and/or listed companies, it is also of interest to unlisted companies and SMEs. This newsletter briefly discusses (1) what the EU aims to achieve with the CSRD and (2) when the CSRD will enter into force, its scope, and how the CSRD will impact your company.

19 December 2022

What does the EU aim to achieve with the CSRD?

The CSRD was adopted in the context of the European Green Deal, in which the European Union (EU) has set itself the goal, amongst others, of making the European economy more sustainable and environmentally aware, so as to reach a climate-neutral Europe by 2050. The CSRD amends a number of existing directives and expands their scope, as the current legislative framework was considered inadequate for achieving the aforementioned goal of the European Union (the main one being the Non-financial Reporting Directive (NFRD)[1] dating from 2014).

More specifically, the CSRD is part of a package of measures aimed at directing financial resources in the European Union toward sustainable activities. By requiring companies to report transparently on ESG factors, consumers and other stakeholders should be able to make informed choices, countering greenwashing and allowing investments to be made in a more sustainable manner.

When will the CSRD enter into force, what is its scope, and how will the CSRD impact your company?

Is your company required to do the sustainability reporting stipulated in the CSRD and, if so, as of when?

The final text of the CSRD was adopted by the Council of the EU on 28 November 2022 and was published in the Official Journal of the European Union on 16 December 2022, after which it will enter into force after 20 days, meaning in early January 2023.

However, before this directive becomes applicable in Belgium, it must be transposed into Belgian law. Like the other EU member states, Belgium has 18 months from its entry into force to do so (until the middle of 2024).

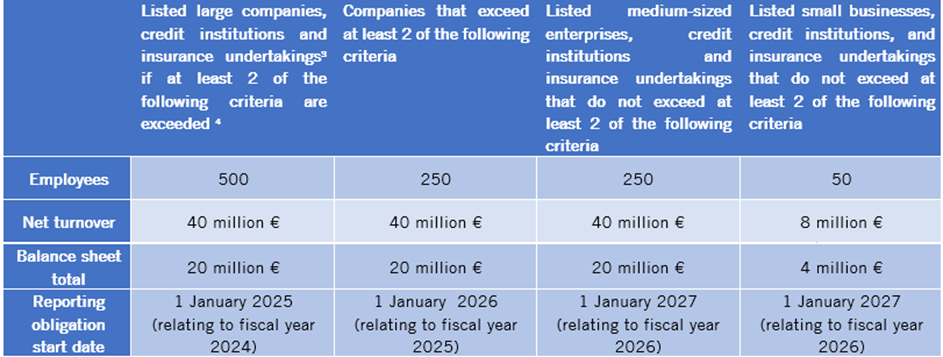

Sustainability reporting must then eventually be conducted by (i) all so-called “large companies” (listed or unlisted) and (ii) listed SMEs. The precise starting date of those obligations depends on the size of the company and the sector in which it operates; see the following chart:

What does sustainability reporting entail?

Companies falling within the scope of the CSRD will have to include certain “sustainability disclosures” in their annual report and management reports that clarify, firstly, the company's impact on ESG factors and, secondly, the impact that the ESG factors have on the company itself (this is the “double materiality principle”). They will have to indicate, amongst other things, the impact on/of the following

Greenhouse gases, pollution and climate change (environment);

protection and prevention at work, diversity and equal opportunities, working conditions, respect for human rights (social and human rights factors);

anti-corruption and bribery, lobbying activities, payment practices (good governance).

Furthermore, reporting must be done in accordance with the European Sustainability Reporting Standards - "ESRS"). Draft versions of these standards were published in November 2022 and are available online. The European Commission will adopt these ESRS by 30 June 2023.

Finally, an assurance services provider consulted by the company[2] will have to express[3] an assurance opinion on the compliance of the sustainability reporting under the CSRD.

Company’s directors and supervisory bodies play an important role. For example, they are collectively responsible for the compliance of the (consolidated) financial statements, (consolidated) annual/governance reports and (consolidated) corporate governance statements with the CSRD. Moreover, the reporting should also provide information about the role and expertise that these directors and supervisory bodies have regarding ESG.

It remains to be seen how these obligations will translate into practice. In any case, it is important that companies develop an internal policy that allows them to collect and centralise the information necessary for sustainability reporting. This will also require companies to have the right underlying mechanisms, strategy and information in place to be able to comply with this reporting obligation (e.g. an anti-corruption policy). It will be important for companies to be well aware of whom they are trading with and where their products come from.

Why is the CSRD also important for companies falling outside its scope?

The CSRD will have an impact not only on the companies covered but also on other companies.

Companies that fall under the scope of the CSRD can only fulfil their reporting obligation if they receive the information required for this purpose from their own suppliers. They must report not only on their own performance, but also on that of their value chain, including their suppliers (even those outside the European Union). Companies targeted by the CSRD will thus impose certain requirements on their value chain, e.g. through contractual obligations, and will also request sustainability information.

A company that does not fall within the scope of the CSRD (such as an unlisted SME) therefore has every interest in drawing up or updating a sustainability strategy if it wishes to continue to cooperate in the future, directly or indirectly, with companies that do fall within the scope.

In addition, voluntary reporting in certain sectors can provide a competitive advantage over companies that do not report.

Moreover, the European Commission is also expected to develop standards for SMEs that wish to report voluntarily by 30 June 2024.

Conclusion

Although the first reporting requirements under the CSRD do not apply until 1 January 2025 (with respect to fiscal year 2024), every company has an interest in getting prepared.

Not only will your company demonstrate the importance it attaches to sustainability, but it will also be ready to meet the requirements that the companies targeted by the CSRD will impose on their suppliers. Competitively, this will immediately put your company one step ahead.

For more information on this topic, please contact Geert De Buyzer, Liesbeth Truyens, Marie-Aude Deslandes or Celine De Buck.

[1] Certain listed companies, credit institutions and insurance undertakings were already covered by the NFRD.

[2] E.g., the statutory auditor (and probably new players in the future).

[3] With a limited degree of certainty.